The UK government ran a surprise £5.4bn surplus in January, after bumper self-assessment income tax receipts, leaving some rooms for giveaways in the chancellor’s budget next month according to some economists.

The surplus was £5bn higher than the government’s fiscal watchdog, the Office for Budget Responsibility, had expected, although it was £7.1bn smaller than in January 2022, according to figures from the Office for National Statistics. Analysts polled by Reuters were taken by surprise, having instead predicted that the government would have to borrow £7.8bn in January.

Government coffers were boosted by £21.9bn of self-assessed income tax receipts, the highest January figure since monthly records began in April 1999. They were partly offset by substantial spending on energy support schemes for households and businesses to cushion the blow of spiralling energy prices, and large one-off payments relating to historic customs duties owed to the EU, the ONS said.

However, the Institute for Fiscal Studies said the cost of energy support was less than expected: “While expensive, the energy support schemes introduced in the last year are actually likely to cost less than forecast in November due to a combination of lower wholesale energy prices and a milder winter.”

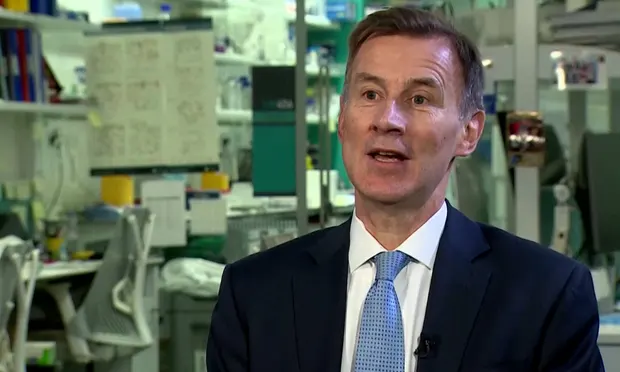

Ruth Gregory, an economist at the consultancy Capital Economics, said the figures suggested the chancellor, Jeremy Hunt, “will have some wriggle room in the budget to fund near-term tax cuts and/or spending rises”.

However, Hunt suggested he was in no mood for giveaways as the UK’s debt pile has surged over recent months. “We are rightly spending billions now to support households and businesses with the impacts of rising prices – but with debt at the highest level since the 1960s, it is vital we stick to our plan to reduce debt over the medium-term.

“Getting debt down will require some tough choices, but it is crucial to reduce the amount spent on debt interest so we can protect our public services.”

Interest payments on government debt have surged in recent months because of the effect of higher inflation on index-linked gilts. Debt interest payable rose to £6.7bn, the highest January figure since monthly records began in April 1997.