The value of the pound has fallen to a two-month low against major currencies after Prime Minister Theresa May signalled the UK would pursue a so-called “hard Brexit” from the EU.

Sterling fell about 1% across the board. The only currency against which it gained ground was the Turkish lira.

The Prime Minister told Sky News on Sunday that she wanted the best possible deal for leaving the EU.

However, she dismissed the idea that the UK could “keep bits of membership”.

She added: “We’re leaving. We’re coming out. We’re not going to be a member of the EU any longer.”

Commentators interpreted this as meaning that Mrs May would not seek to keep the UK in the EU’s single market, with radical consequences for the country’s economy.

‘Populist politics’

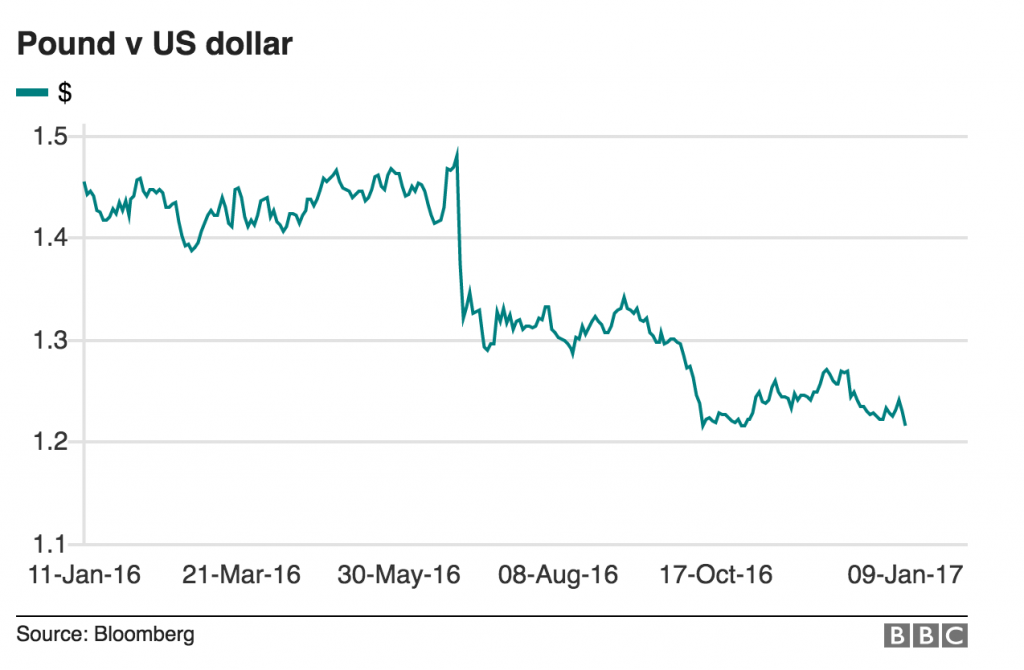

By late morning, the pound was down 1.06% against the dollar at $1.2155, while against the euro, it was 0.89% lower at €1.1561.

“Sterling is on the back foot on Monday after Theresa May’s comments were taken as a sign the UK government would prioritise immigration controls over single market access,” said Neil Wilson, senior market analyst at ETX Capital.

“Domestic populist politics trumps the trade card for now, it seems, and that is weighing on the pound.”

Mr Wilson predicted “more volatility” in the sterling exchange rate, adding that it could easily “bounce back” as the tone of political discourse shifted.

HSBC currency strategist Dominic Bunning agreed: “[Mrs] May saying that it’s not about keeping ‘bits’ of the EU suggests it’s not going to be about keeping access to the single market.

“She said we will have full control of our borders, and given what the other side of the debate – the EU – has said, that’s not compatible with full access to the single market, free movement of capital, free movement of goods and services.

“That’s the direct trade-off that the [foreign exchange] market is looking at.”

Inflation rising

Paresh Davdra, chief executive of RationalFX, said: “The looming fears that the UK might exit the single market continue to weigh down on the pound, and we expect the volatility to continue until further and actual on-ground clarity emerge.

However, he added: “All is not lost for the UK, as the fall in the pound’s value has attracted international market activity and simultaneously boosted the country’s export figures.”

The pound fell sharply in the immediate aftermath of the UK’s June 2016 vote to leave the EU.

The weaker pound makes UK goods cheaper for buyers overseas, but increases the cost of imported goods.

Analysts expect UK inflation to pick up this year as the impact of higher import costs feeds through to the economy. Last week, a string of economic surveys indicated that companies were facing rising price pressures as import costs increased.

November’s Consumer Prices Index (CPI) inflation rate was 1.2%, up from 0.9% in October and the highest since October 2014, when it stood at 1.3%.